Overview

At the Royal Bank of Canada (RBC), the push towards improving client experience is more than just a corporate goal, it's a commitment to understand and address client needs at the most personal level.

This case study explores my role as a Banking Advisor, UX Researcher, and Data Visualization Analyst at RBC where I used what clients told us and tools like Figma, Tableau, Excel, and the RBC App Suite to improve the client experience by focusing on 3 main client pain points.

This case study explores my role as a Banking Advisor, UX Researcher, and Data Visualization Analyst at RBC where I used what clients told us and tools like Figma, Tableau, Excel, and the RBC App Suite to improve the client experience by focusing on 3 main client pain points.

Understanding the Project Need

Discovering the Issues

The project began with a focus on first-hand user research. My goal was to put myself in the client's world and understand their daily challenges and frustrations directly from their perspective.

Learning and Adapting

I started with a comprehensive three-week training, learning to use RBC’s banking advisor applications under experienced advisors and a very supportive manager. This phase was important in shaping my approach to client interactions, focusing on empathy and effective problem-solving.

Focusing on What Matters

We needed to turn real feedback into real changes. That meant understanding the most common complaints and frustrations and figuring out how to fix them.

The project began with a focus on first-hand user research. My goal was to put myself in the client's world and understand their daily challenges and frustrations directly from their perspective.

Learning and Adapting

I started with a comprehensive three-week training, learning to use RBC’s banking advisor applications under experienced advisors and a very supportive manager. This phase was important in shaping my approach to client interactions, focusing on empathy and effective problem-solving.

Focusing on What Matters

We needed to turn real feedback into real changes. That meant understanding the most common complaints and frustrations and figuring out how to fix them.

User Research

How was the research carried out?

I carried out primary research by talking first-hand to over 3000 clients. They shared their banking stories, frustrations, confusions, and the little things that could make their days easier. These conversations opened my eyes to the real challenges they faced daily and every chat with a client was a chance to learn something new.

These feedbacks were collected and normalized using Microsoft Excel, then split into these categories:

• Province

• Category of call reason

• Number of calls

I carried out primary research by talking first-hand to over 3000 clients. They shared their banking stories, frustrations, confusions, and the little things that could make their days easier. These conversations opened my eyes to the real challenges they faced daily and every chat with a client was a chance to learn something new.

These feedbacks were collected and normalized using Microsoft Excel, then split into these categories:

• Province

• Category of call reason

• Number of calls

What did I learn?

My analysis showed clear trends in areas of client dissatisfaction, guiding the prioritization of my solution development. My focus was on these 3 main categories:

• Bills

• Unexpected NSF fees as a result of overnight processing

• Holds on check and draft deposits.

My analysis showed clear trends in areas of client dissatisfaction, guiding the prioritization of my solution development. My focus was on these 3 main categories:

• Bills

• Unexpected NSF fees as a result of overnight processing

• Holds on check and draft deposits.

Specifically, approximately 9.2% of all calls were related to billing issues, indicating a substantial area for improvement in how clients manage and understand their bill payments. Additionally, about 2.5% of calls involved NSF (Non-Sufficient Funds) fees, which were primarily due to a lack of client education on transaction timings and account management. Holds on accounts, which accounted for around 2.09% of total calls, also highlighted a critical need for clearer communication and policy transparency.

Our Data showed that 41% of total client interaction came from Ontario, indicating a regional focus for targeted improvements and simple graphs showed clear trends. More complaints didn’t just mean more problems; it meant more opportunities to improve.

Our Data showed that 41% of total client interaction came from Ontario, indicating a regional focus for targeted improvements and simple graphs showed clear trends. More complaints didn’t just mean more problems; it meant more opportunities to improve.

9.2%

Nearly 1 in 10 calls were bill-related, indicating a substantial area for improvement in how clients can self-serve bill payments.

2.5%

Involved NSF (Non-Sufficient Funds) fees, which were primarily due to a lack of client education on transaction timings and account management.

2.09%

Facing uncertainty with fund holds highlighted a critical need for clearer communication and policy transparency.

Client Pain Points

“Now my credit score is ruined because I will miss a lot of bill payments.”

How can we make the Client Experience better for everyone?

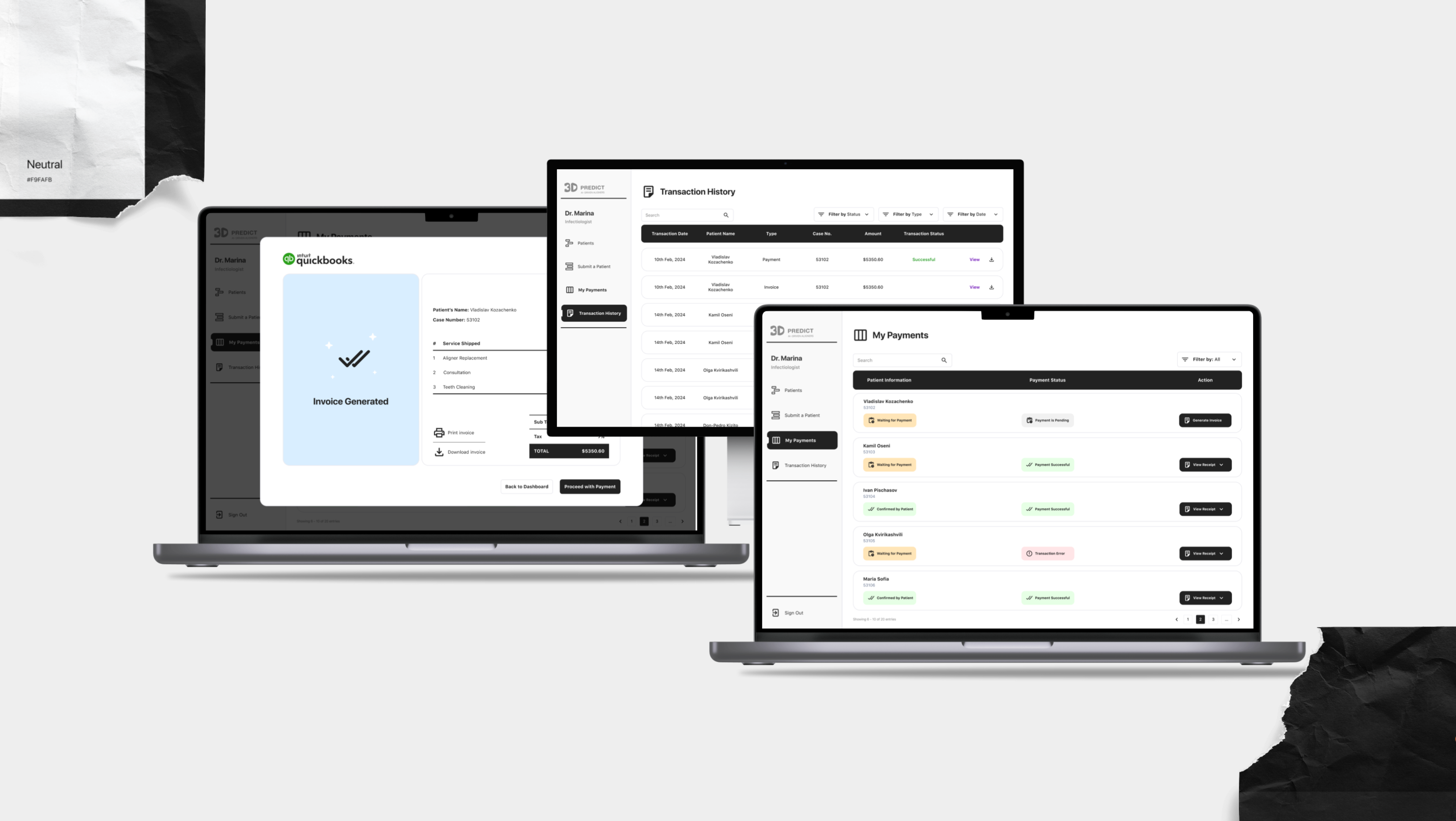

For the best experience, accessibility and communication were key. The proposed solutions were designed to address the specific frustrations identified during research:

Looking Back and Ahead

Challenges and Growth:

Talking directly to clients, though initially overwhelming, became the most rewarding part of my role, improving my understanding of and capacity for empathy.

Learning to use Tableau from scratch was a significant challenge, but my background in database management and SQL provided a strong foundation for quickly mastering data visualization.

Talking directly to clients, though initially overwhelming, became the most rewarding part of my role, improving my understanding of and capacity for empathy.

Learning to use Tableau from scratch was a significant challenge, but my background in database management and SQL provided a strong foundation for quickly mastering data visualization.

Lessons learned:

This project was a real learning experience that extended beyond technology and banking; it was a lesson in humanity. Handling real client calls expanded my appreciation for the importance of client satisfaction and the impact of thoughtful service. It taught me more than I could have imagined about technology, finance, and, most importantly, about people.

This project was a real learning experience that extended beyond technology and banking; it was a lesson in humanity. Handling real client calls expanded my appreciation for the importance of client satisfaction and the impact of thoughtful service. It taught me more than I could have imagined about technology, finance, and, most importantly, about people.

Final Thoughts:

This project improved my skills and will position RBC to move closer to its goal of digital enablement, where clients can efficiently self-serve. By addressing these key client concerns, RBC can enhance client loyalty and operational efficiency, making the digital platform more intuitive and user-friendly.

This project improved my skills and will position RBC to move closer to its goal of digital enablement, where clients can efficiently self-serve. By addressing these key client concerns, RBC can enhance client loyalty and operational efficiency, making the digital platform more intuitive and user-friendly.

As we continue to improve our services, the insights gained from this project will guide our efforts to ensure that every client interaction with RBC is straightforward, respectful, and empowering. This journey of empathy and innovation is just beginning, and its continued focus on real client feedback will drive our success.